- Cosco Shipping, OOIL benefited from higher freight rates

- Firms relying on exports suffered from higher logistics costs

Gift this article

In this Article

Follow

COSCO SHIPPING Holdings Co Ltd

Follow

Orient Overseas International Ltd

Follow

Follow

Follow

Have a confidential tip for our reporters? Get in TouchBefore it’s here, it’s on the Bloomberg Terminal LEARN MORE

By Harshita Swaminathan and Rachel Yeo

September 12, 2024 at 7:08 AM GMT+7

Save

Listen

3:01

Supply Lines is a daily newsletter that tracks global trade. Sign up here.

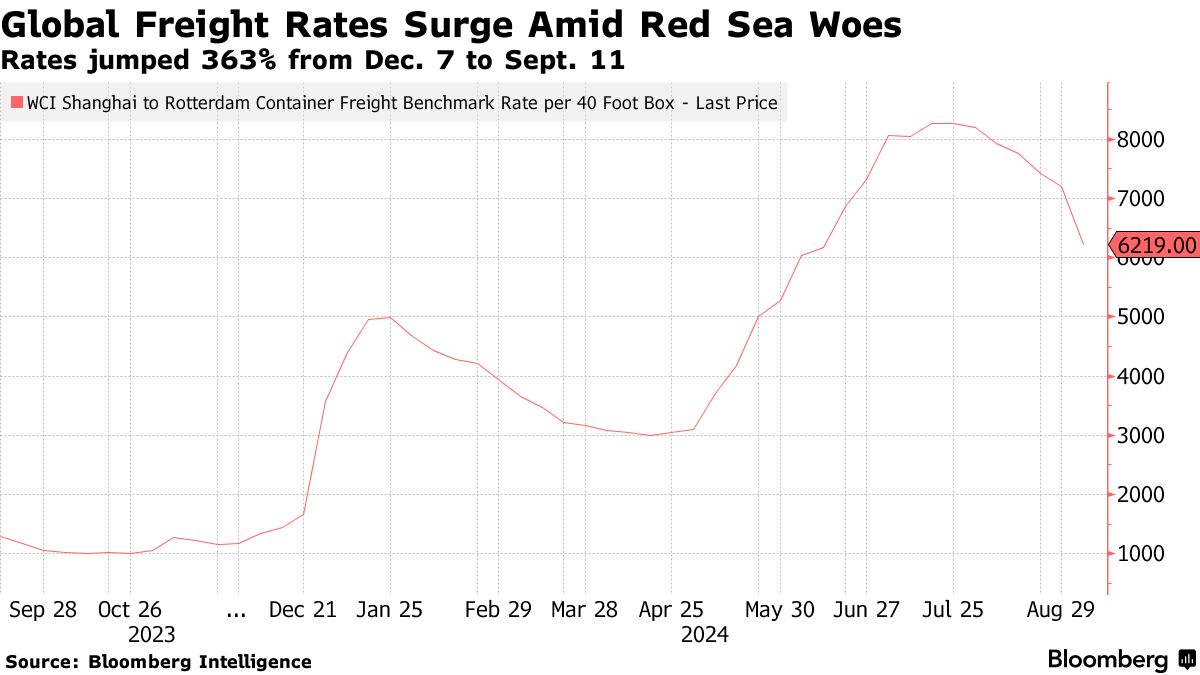

First-half earnings in Asia showed how the ripple effects of the Red Sea crisis will continue to be costly for companies that make goods for export, while those that transport their wares benefit from higher freight rates.

Containerships avoiding the risk of being attacked in the Red Sea reduced vessel traffic in the narrow passageway by about 70% as of mid-July from December, according to Bloomberg Intelligence. That increased transit times and freight rates.

Chinese shippers including Cosco Shipping Holdings Co. saw earnings lifted by higher revenue from its container shipping business, while Orient Overseas International Ltd. said its transpacific trade route performed better as tight supply chain contributed to higher freight rates.

On the flip side, companies including Miniso Group Holding Ltd. are being battered by higher logistics costs. Dixon Technologies India Ltd., a Xiaomi Corp. supplier, said margins suffered from higher freight costs, and motorbike maker TVS Motor Co. said exports faced longer transit times.

“The containerliner industry and the supply chain it connects are being buffeted once again, this time by the prolonged crisis in the Red Sea,” said Bloomberg Intelligence analysts Lee A Klaskow and Kenneth Loh. “The near-term result has been a surge in container rates and liner earnings.”

The Iran-backed Houthis, who control parts of northwestern Yemen, have been attacking ships with drones and missiles since mid-November. The Islamist militants say they are targeting Israeli- and Western-linked vessels in solidarity with Palestinians as the war in Gaza continues. An increasing number of merchant ships have opted for longer routes to bypass the area.

“We believe rates will return to below breakeven once supply chains normalize, due to the structural challenges facing the industry,” the BI analysts said, adding that a widening supply-demand gap will likely weigh on the outlook for container rates and liner earnings.

The effects were mixed for port operators. China Merchants Port Holdings Co. said its port in Sri Lanka benefited from the increase in transshipment cargoes due to the Red Sea situation, whereas container volumes at its Turkey port were lower. Adani Ports and Special Economic Zone Ltd., India’s biggest port operator, saw overall volumes grow, whereas Gujarat Pipavav Port Ltd. said container volumes fell due to skip calls.

Other beneficiaries include companies in the air cargo space, as businesses seek alternatives to longer shipping times.

This helped Singapore Airlines Ltd. lift its cargo load factor by 5.9 percentage points in the April-June quarter from a year earlier. The carrier pointed to “strong e-commerce flows and increased demand for air freight driven by the Red Sea crisis.”

Cathay Pacific Airways Ltd. also said it carried about 10% more cargo volume between January and June. The airline, along with HSBC analysts, expects demand will remain at healthy levels until the end of the year.

MSC Mediterranean Shipping Co.’s Chief Executive Officer Soren Toft sees no end to the Red Sea crisis anytime soon.

“I believe there will not be any short-term solution on the horizon” to guarantee safe passage in the area, the leader of the world’s largest container line told Bloomberg News earlier this week.

— With assistance from Paul Wallace